The volatility of cost and availability of steel components has thrown steel supply chains into chaos and it could be some time before they re-adjust to the new normal brought by U.S. tariffs, say sector stakeholders.

The root cause is a trade war between Canada and the United States which began last spring.

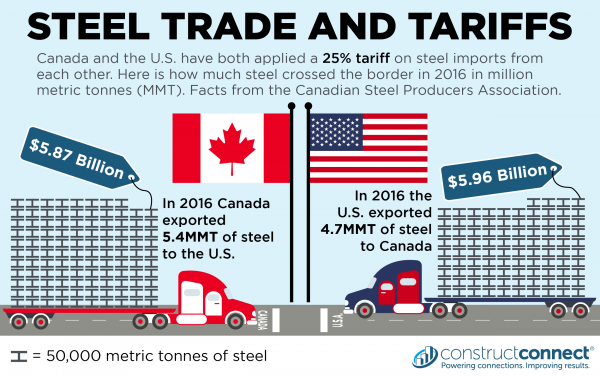

U.S. President Donald Trump fired the first shot, slapping 25 per cent tariffs on Canadian steel and 10 per on aluminum. Canada responded in kind, slapping the same tariffs on imported American steel.

As a result, steel prices started soaring and the Canadian steel fabrication and construction sectors both started feeling the ripple effects.

A majority of the wide flange beams most common to Canadian construction comes from the U.S. says Ed Whalen, president and CEO of Canadian Institute of Steel Construction (CISC) and it has thrown supply chains into chaos, he says.

Sourcing from the U.S. means fabricators and construction companies can get the materials they need on site fairly quickly, whereas now they have to source from outside the U.S. to avoid the tariffs. Even with the extra shipping costs it’s more affordable than the tariff, he says.

Realigning those supply chains to source from both inside and outside Canada is the issue, Whalen says, with the added pressure of not knowing how long a NAFTA deal might take and how quickly the tariffs are removed and things get back to normal.

“Then there’s the issue of shipping east to west,” he says. “We can ship by rail but we’re competing against grain which is heading to Europe — where they’ve had a crop failure and of course, oil.”

Taking the pressure off rail by diverting oil is another critical factor for getting pipelines to tidewater, he says.

How this will net out and how long those supply chains will take to return to normal is anyone’s guess, says Joseph Galimberti, president of the Canadian Steel Producers Association.

“The most interesting effect as opposed to price increase is really in the supply chains which have been built up over generations to provide high quality products,” he says. “It is more about the disruption in the ways of doing business and supply patterns.”

He says it going to take time for commercial relationships to shift and the impact has been a decline in steel to the U.S.

Still, he says the ripple effect as steel consumers start to find other sources and supply routes is that other jurisdictions are adding tariffs too, creating more chaos.

So far, the federal government has collected some $300 million in tariffs in July and August from a range of goods including steel, aluminum and foods. It plans to redistribute the money to those hit hardest financially from the U.S. tariffs.

With those supply chains readjusting on the fly, the cost of construction is climbing too, says Richard Lyall, president of the Residential Construction Council of Ontario (RESCON).

“I think the Canadian government has handled this well and listened,” he says but there’s a balancing act in that sourcing from outside of Canada will cost jobs if prices continue to climb and then jobs in construction will be lost. “They need to be surgical in their response and not sideswipe our industry.”

The low-rise sector has been hammered in the last six months, he says, and high-rise is the last sector still performing.

Lyall says the cost of rebar has been bumped as has the cost of steel plate because there’s no source in Canada for it while structural steel has also taken a hit.

Some estimates say it could add up to $12,000 to the cost of each unit in a multi-story condo project but Whalen says he doesn’t think the impact is that high.

The issue of uncertainty becomes an overarching narrative, Lyall adds, with suppliers and fabricators starting to worry whether they’ll get paid if projects start to shut down or get cancelled.

“Then you have a risk premium thrown into the equation,” he says. “And I’m really worried about that.”

While the Atlantic, central Canada and western provinces are pretty much in the same supply chain dilemma, B.C. was already taking a hit because it costs more to ship steel from the mills in the east so they’ve traditionally sourced from the U.S., says Whalen

The issue then becomes the anti-dumping measures put in place to stop cheap steel being brought to B.C. from Asia.

“We want steel at market prices to be fair to everyone,” he says noting Canadian mills need protection too.

Recent Comments