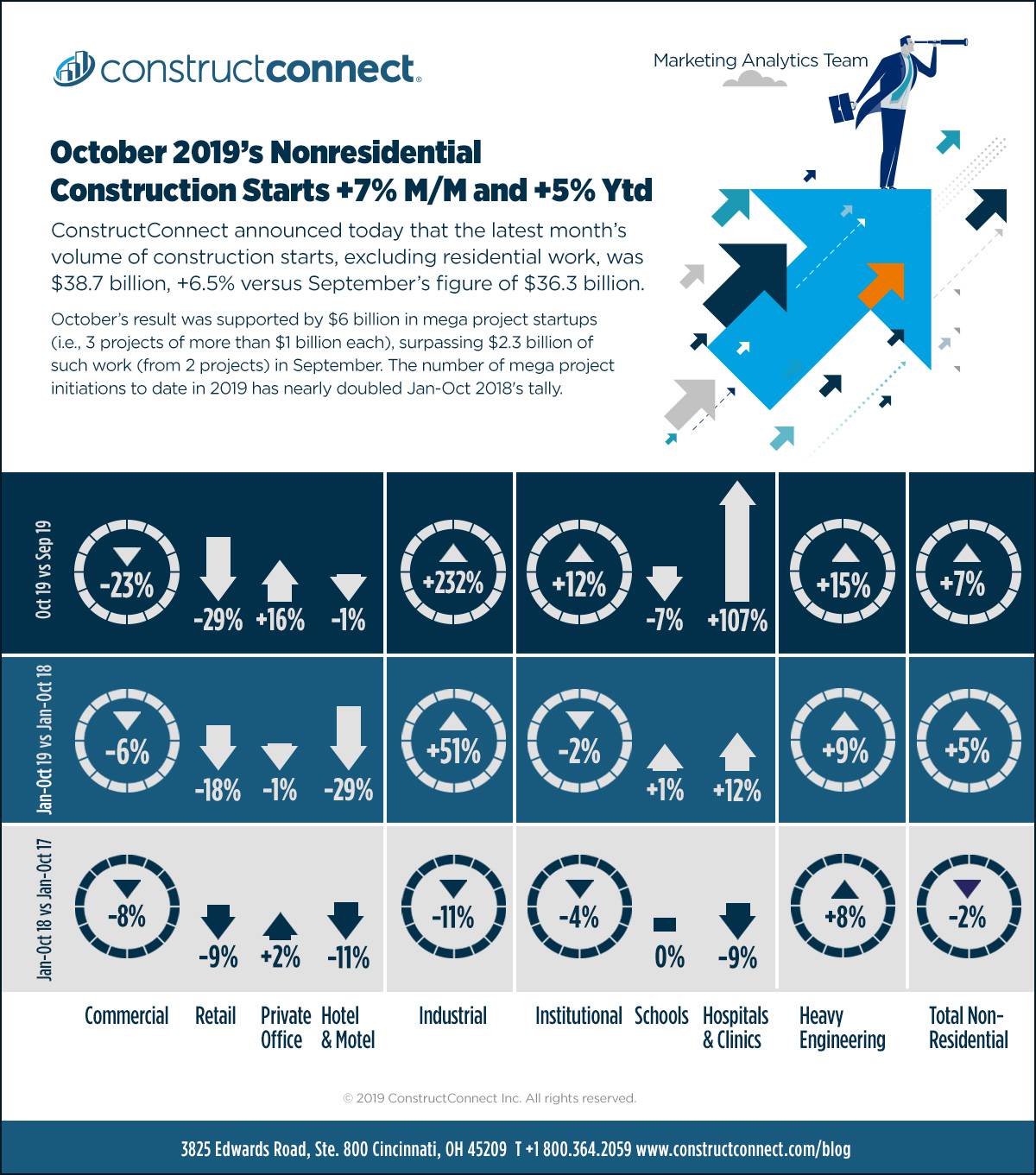

ConstructConnect announced today that the latest month’s volume of construction starts, excluding residential work, was $38.7 billion,+6.5% versus September’s figure of $36.3 billion (originally reported as $34.7 billion). From September to October, there is usually a change of -4% in total nonresidential starts due to ‘seasonality’.

October’s result was supported by $6 billion in mega project startups (i.e., 3 projects of more than $1 billion each), surpassing $2.3 billion of such work (from 2 projects) in September. Read the complete October 2019 Industry Snapshot article here: October 2019’s Nonresidential Construction Starts +7% M/M and +5% Ytd.

To date in 2019, there have been 29 mega project initiations with a total estimated valuation of $72 billion compared with 16 such projects in the first ten months of last year, for $40 billion.

October 2019’s total nonresidential start’s level was almost an exact match for October 2018 (+0.3%). October 2019’s year-to-date volume was +4.5% above January-October of last year.

View this information as an infographic.

Construction Overview – Monthly Average Jobs Growth -56%

The total number of jobs in the U.S. construction sector rose by +10,000 in October, cutting the year-to-date monthly average to +13,000. This year’s monthly average jobs increase has fallen more than 50% below last year’s pace of +29,000. The NSA unemployment rate in the sector has bobbed up to 4.0% from 3.2% the month before. A year ago, in October 2018, it had been 3.6%.

Construction’s year-over-year jobs climb of +2.0% is still beating the economy-wide ‘all-jobs’ performance of +1.4%, but it has not kept up with ‘education and health’, at +2.7%, and ‘leisure and hospitality’, +2.4%. Nevertheless, +2.0% is far better than manufacturing’s +0.4% or retail’s -0.1%.

October’s year-over-year employment changes in sub-segments of the economy with close ties to construction were: ‘oil and gas extraction’, +11.8%; ‘machinery and equipment rental’, +8.9%; ‘real estate activities’, +2.7%; ‘architectural and engineering services’, +2.4%; ‘cement and concrete product manufacturing’, +1.3%; and ‘building material and supplies dealers’, +0.7%.

Click here to download the Construction Industry Snapshot Package – October 2019 PDF.

Click here for the Top 10 Project Starts in the U.S. – October 2019.

Click here for the Nonresidential Construction Starts Trend Graphs – October 2019.

Alex Carrick is Chief Economist for ConstructConnect. He has delivered presentations throughout North America on the U.S., Canadian and world construction outlooks. Mr. Carrick has been with the company since 1985. Links to his numerous articles are featured on Twitter @ConstructConnx, which has 50,000 followers.

Recent Comments

comments for this post are closed