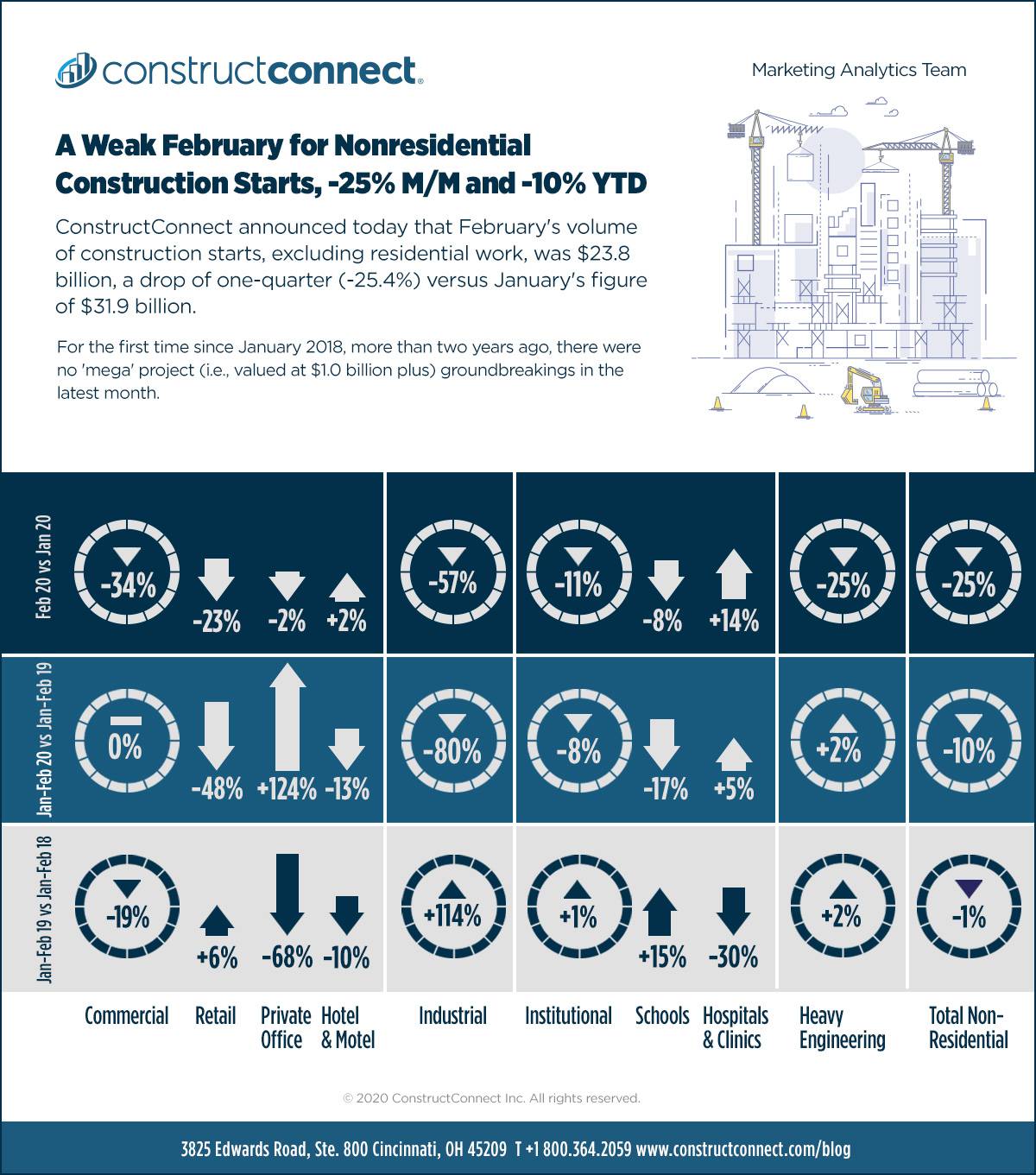

ConstructConnect announced today that the latest month’s volume of construction starts, excluding residential work, was $23.8 billion, a drop of one-quarter (-25.4%) versus January’s figure of $31.9 billion (originally reported as $29.7 billion).

For the first time since January 2018, more than two years ago, there were no ‘mega’ project (i.e., valued at $1.0 billion plus) groundbreakings in the latest month.

Read the complete February 2020 Industry Snapshot article here: A Weak February for Nonresidential Construction Starts, -25% M/M and -10% Ytd.

The months of 2019 were brimming with mega projects. There were 35 altogether, or an average of nearly three per month, with a combined sum of $79.1 billion. In 2020, there has been only one mega project to date, January’s $2 billion ‘people mover’ at LAX.

View this information as an infographic.

Coronavirus Impacts on Mega Projects

The negative impacts from coronavirus fears spreading throughout the economy ‒ e.g., by way of conference, trip and hotel cancellations and ‘social distancing’ that keeps consumers away from shopping malls and sporting, cultural (SXSW) and political events (rallies) ‒ are sure to cut into national output, at least through the first half of this year.

In such a climate, it seems unlikely many owners will be willing to issue go-aheads for major capital spending initiatives. They’ll wait to learn more about the extent of the contagion. Most important, they’ll want clear signs that the spread is abating.

Construction Overview – Crackerjack Hiring in First Two Months

The U.S. construction sector recorded another banner month for hiring in February, +42,000 jobs, on the heels of +49,000 in January. The first two months of this year were +91,000 jobs versus +21,000 in January-February 2019. Construction’s NSA unemployment rate in the latest month was 5.5%, up a notch from 5.4% in January, but still better than February 2019’s 6.2%.

Among major sectors of the economy, construction has retaken the lead in year-over-year jobs growth. At +3.0% y/y in February, construction was a little out front of second place ‘education and health’, +2.8%, and comfortably ahead of third place ‘leisure and hospitality’, +2.4%. U.S. total employment in February was +1.6% y/y. There have been two sectors with stagnant payrolls ‒ manufacturing, at +0.2%, and retail, -0.1%.

The latest year-over-year job count changes in other corners of the economy with close ties to construction have been: ‘oil and gas extraction’, +9.3%; ‘machinery and equipment rental’, +4.5%; ‘real estate activities’, +3.3%; ‘architectural and engineering services’, +2.6%; ‘building material and supplies dealers’, +1.2%; and ‘cement and concrete product manufacturing’, +0.5%

Click here to download the Construction Industry Snapshot Package – February 2020 PDF.

Click here for the Top 10 Project Starts in the U.S. – February 2020.

Click here for the Nonresidential Construction Starts Trend Graphs – February 2020.

Alex Carrick is Chief Economist for ConstructConnect. He has delivered presentations throughout North America on the U.S., Canadian and world construction outlooks. Mr. Carrick has been with the company since 1985. Links to his numerous articles are featured on Twitter @ConstructConnx, which has 50,000 followers.

Recent Comments