An important story that’s emerging in what are hopefully the winding-down days of the pandemic concerns supply shortages and cost hikes. The all-items U.S. Consumer Price Index (CPI), which has been consistently under +2.0% year over year for an extended period, suddenly shot up to +4.2% y/y in April, as a result of moving +0.8% in just one month.

As everyday shoppers, you and I may feel we have something to gripe about. But consider the plight of the unfortunate contracting community. Our soaring expense frustrations pale beside what beleaguered contractors are facing.

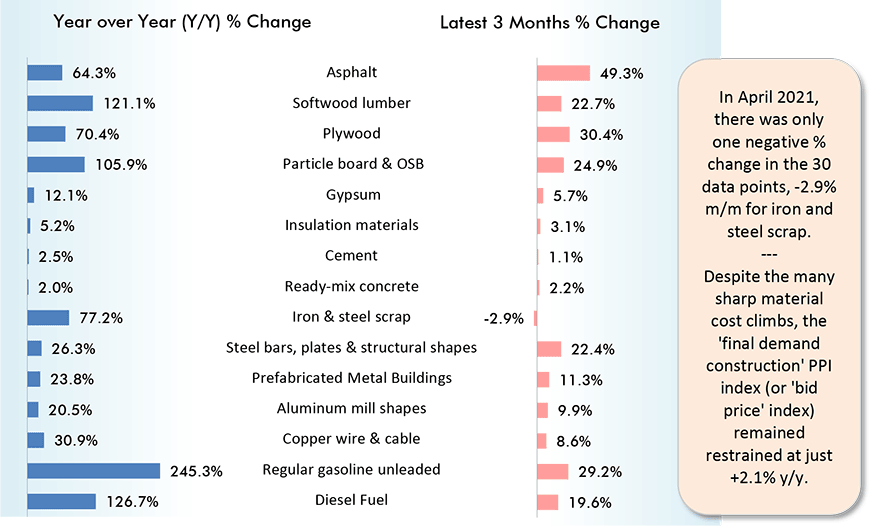

Table 1 shows y/y and latest-three-month price hikes for 15 major construction materials and some of the key ingredients of building products (e.g., aluminum in ventilation systems).

Table 1 is a subset of Table 2 which appears at the end of this article and includes a comprehensive list of construction material inputs and special indices. All the numbers come from the Producer Price Index (PPI) data set compiled by the Bureau of Labor Statistics (BLS).

Among the 15 items in Table 1 and for the year-over-year and month-to-month time frames, there’s only one instance of a declining index value, -2.9% m/m for iron and steel scrap. But also notice that iron and steel scrap on a y/y basis is +77.2%.

Four items in the left-hand column of Table 1 have more than doubled in price over the past year: softwood lumber, +121.1%; particle board & OSB, +105.9%; regular gasoline, +245.3%; and diesel fuel, +126.7%.

The upwards adjusting ‘forestry’ and ‘steel’ product price movements have been ongoing for a while. More recently piquing our interest, though, have been the accelerating price trends for aluminum mill shapes and copper wire and cable. The former is +20.5% y/y and +9.9% m/m; the latter, +30.9% y/y and +8.6% m/m.

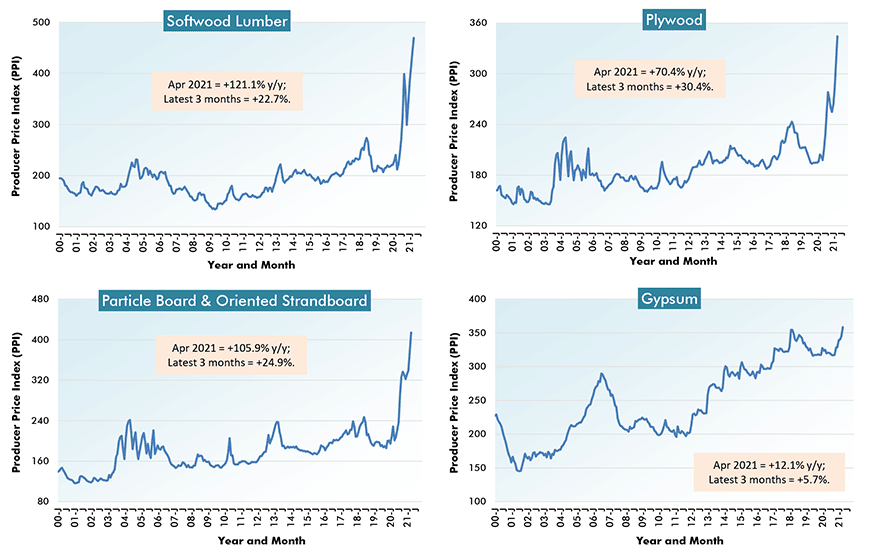

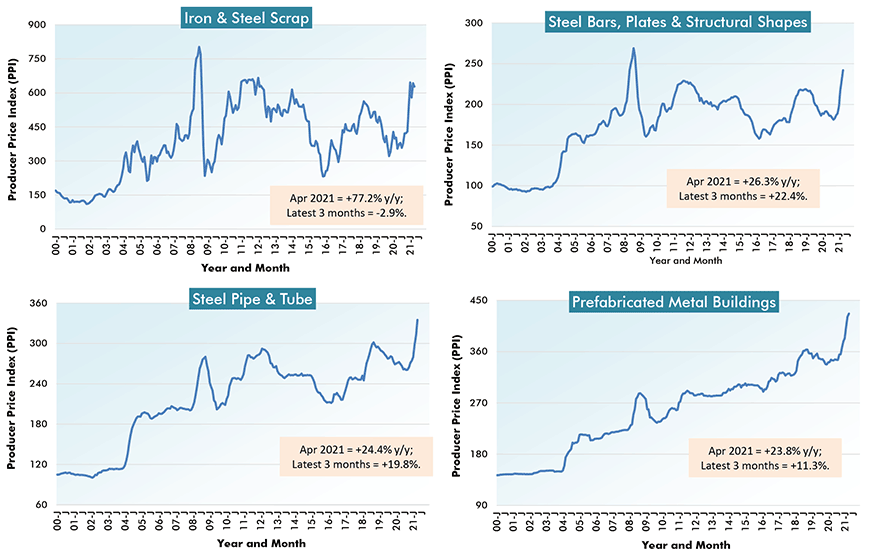

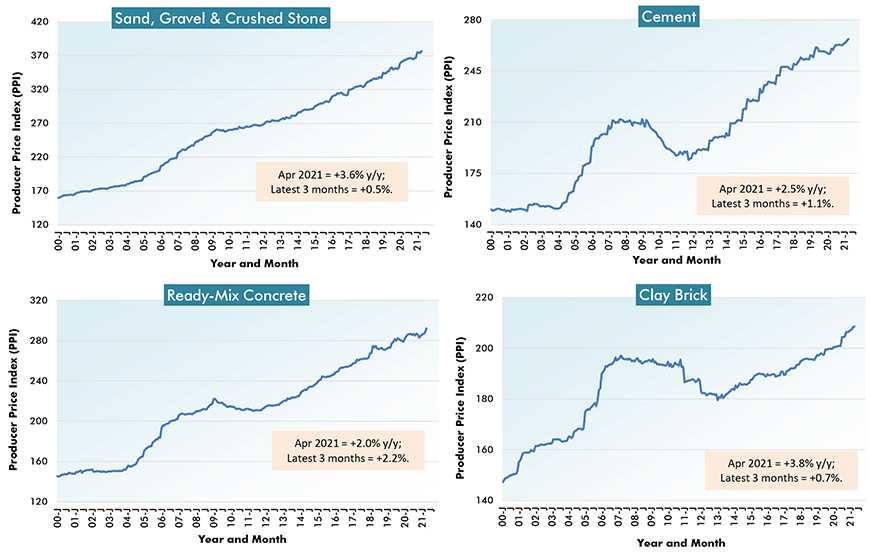

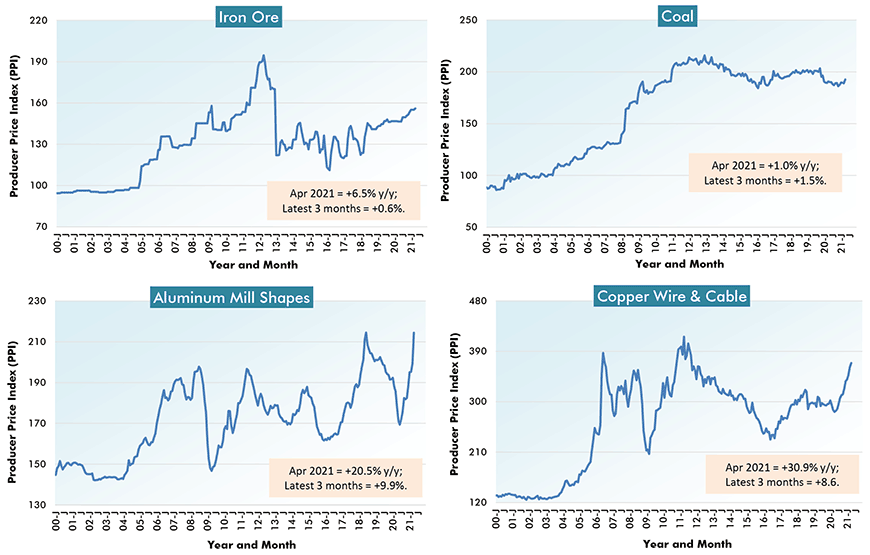

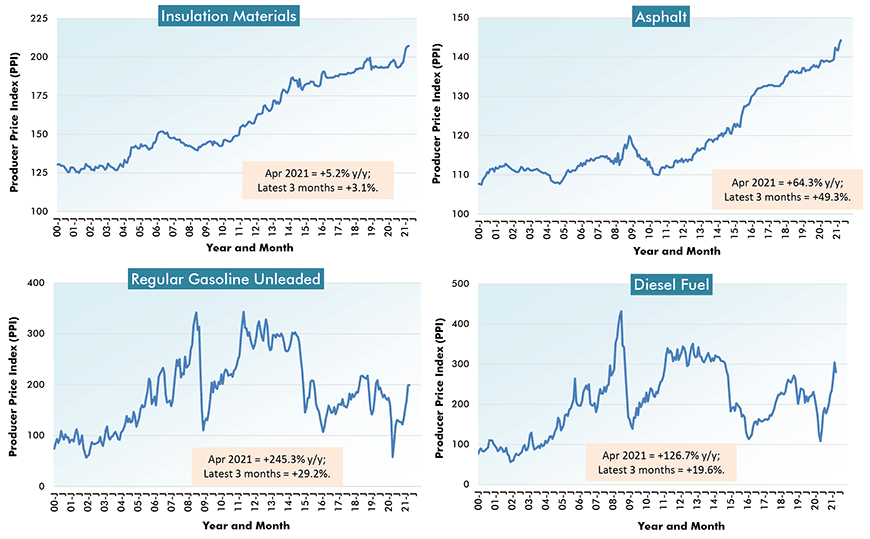

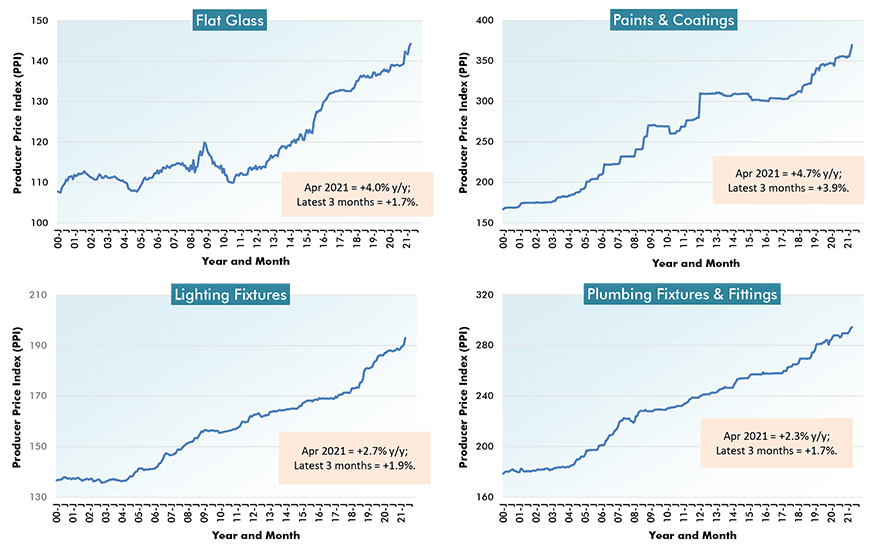

On the principle, that it’s often easier to grasp what is occurring when one sees a picture, cluster-graphs 1 through 6 show the history of the price indices for 24 of the PPI construction-related material indices.

From Producer Price Index (PPI) Series – April 2021

Charts: ConstructConnect.

Forestry Products & Paneling

In Graph 1, the softwood lumber, plywood and particle board/OSB price index curves have been skyrocketing of late and reaching new summits. Gypsum, while not launching into orbit in quite the same dramatic fashion, is still elevated relative to its history.

Charts: ConstructConnect.

Steel Products

In Graph 2, the ‘steel bars, plates and structural shapes’ price index curve is climbing, although it still has a way to go to match its elevation in 2008. The ‘steel pipe and tube’ and ‘prefabricated metal building’ curves, though, are at new heights.

Charts: ConstructConnect.

Cement, Concrete & Brick

All the curves in Graph 3 show steadier, less volatile, progressions of price increases over the past decade. Nevertheless, they’re also presently as high as they’ve been since the corner was turned on the new century. The highest y/y percentage change appearing in Graph 3’s text boxes is +3.8% for clay brick.

Charts: ConstructConnect.

Base Materials

From Graph 4, iron ore and coal prices are exceptions to the general stepping-up rule these days, as they’re simply moving sideways. Aluminum and copper, though, have definitely jumped on board the ascending price elevator.

Charts: ConstructConnect.

Fiberglass & Energy-Derived Products

The PPI index (which measures prices as goods exit through factory or refinery ‘gates’) for regular unleaded gasoline is +245.3% y/y, but that still leaves it well short of previous peaks. By the way, the latest measure of the gasoline sub-index in the CPI series (i.e., ‘at the pump’) is +49.6% y/y. The diesel fuel PPI has also seen an outsized gain, +126.7% y/y and +19.6% m/m.

The price of asphalt for roads is up by nearly two-thirds (+64.3%) y/y and by one-half (+49.3%) in April alone.

It seems likely that a major infrastructure spending initiative (including road building), as proposed by the new administration in Washington, will be knocked about more than a bit by a seriously escalating cost structure.

Charts: ConstructConnect.

Accessories & Arterial

The heftiest year-over-year advance for the four building products set out in Graph 6 is the +4.7% for paints and coatings. Because titanium is a metal that’s stronger and lighter than steel, it’s used in the framing of space craft. Because it bonds well with human bones, it’s utilized in hip and knee replacements and dental work.

In the construction context, though, titanium is a crucial ingredient in the white pigment of paint. Following a similar pattern to many other metals, the price of titanium is on a rebound.

Charts: ConstructConnect.

% Change in the April 2021 Index from:

| 3 Years | 1 Year | 6 months | 3 months | 1 month | |||||

| Ago | Ago | Ago | Ago | Ago | |||||

| Final Demand/Service/Commodity/Energy/Input: | |||||||||

| Final Demand Construction | 10.5% | 2.1% | 2.2% | 1.8% | 1.1% | ||||

| New warehouse building construction | 9.5% | 1.8% | 2.7% | 2.1% | 2.0% | ||||

| New school building construction | 10.7% | 1.1% | 1.4% | 1.3% | 0.9% | ||||

| New office building construction | 11.5% | 3.5% | 3.4% | 2.6% | 0.5% | ||||

| New industrial building construction | 11.8% | 1.6% | 1.1% | 0.9% | 0.7% | ||||

| New health care building construction | 10.6% | 2.6% | 2.5% | 3.2% | 2.5% | ||||

| Architectural & engineering services | 5.3% | 2.5% | 2.5% | 0.8% | 0.2% | ||||

| Construction machinery & equipment | 9.5% | 1.4% | 1.4% | 0.3% | 0.1% | ||||

| Asphalt | 30.6% | 64.3% | 67.0% | 49.3% | 16.3% | ||||

| Plastic construction products | 16.7% | 14.2% | 10.0% | 7.8% | 3.3% | ||||

| Softwood lumber | 87.6% | 121.1% | 28.7% | 22.7% | 6.4% | ||||

| Hardwood lumber | 15.2% | 31.6% | 29.2% | 15.7% | 3.5% | ||||

| Millwork | 18.9% | 14.0% | 6.9% | 3.9% | 1.8% | ||||

| Plywood | 45.5% | 70.4% | 27.6% | 30.4% | 10.0% | ||||

| Particle board & oriented strandboard (OSB) | 77.0% | 105.9% | 23.0% | 24.9% | 9.8% | ||||

| Gypsum | 2.8% | 12.1% | 13.0% | 5.7% | 3.9% | ||||

| Insulation materials | 7.5% | 5.2% | 6.8% | 3.1% | 0.1% | ||||

| Construction sand, gravel & crushed stone | 13.0% | 3.6% | 3.2% | 0.5% | 0.7% | ||||

| Cement | 6.3% | 2.5% | 1.5% | 1.1% | 0.4% | ||||

| Ready-mix concrete | 7.0% | 2.0% | 2.1% | 2.2% | 1.5% | ||||

| Precast concrete products | 14.1% | 5.3% | 4.5% | 2.8% | 1.6% | ||||

| Prestressed concrete products | 8.3% | 0.2% | 3.0% | 1.9% | 1.3% | ||||

| Brick (clay) | 6.5% | 3.8% | 1.1% | 0.7% | 0.1% | ||||

| Coal | -3.2% | 1.0% | 1.8% | 1.5% | 1.9% | ||||

| Iron ore | 15.4% | 6.5% | 3.4% | 0.6% | 0.6% | ||||

| Iron & steel scrap | 11.5% | 77.2% | 48.5% | -2.9% | -2.4% | ||||

| Steel bars, plates & structural shapes | 22.4% | 26.3% | 32.3% | 22.4% | 5.1% | ||||

| Steel pipe & tube | 23.8% | 24.4% | 26.6% | 19.8% | 7.4% | ||||

| Fabricated structural metal products | 15.9% | 12.7% | 12.9% | 9.7% | 2.8% | ||||

| Prefabricated Metal Buildings | 22.4% | 23.8% | 20.1% | 11.3% | 1.3% | ||||

| Aluminum mill shapes | 6.6% | 20.5% | 17.9% | 9.9% | 7.5% | ||||

| Flat glass | 5.8% | 4.0% | 3.7% | 1.7% | 0.6% | ||||

| Paints, architectural coatings | 16.2% | 4.7% | 4.0% | 3.9% | 2.1% | ||||

| Lighting fixtures | 11.4% | 2.7% | 2.2% | 1.9% | 1.4% | ||||

| Plumbing fixtures & fittings | 9.2% | 2.3% | 1.7% | 1.7% | 0.4% | ||||

| Elevators & escalators | 8.4% | 1.7% | 1.6% | 1.6% | 0.5% | ||||

| Heating equipment | 16.1% | 6.6% | 6.4% | 6.1% | 3.8% | ||||

| Air conditioning equipment | 13.1% | 5.1% | 4.7% | 2.9% | 0.8% | ||||

| Copper wire & cable | 18.5% | 30.9% | 17.8% | 8.6% | 2.0% | ||||

| Regular gasoline unleaded | 0.7% | 245.3% | 57.5% | 29.2% | 0.4% | ||||

| Diesel Fuel | 20.9% | 126.7% | 49.6% | 19.6% | -8.0% | ||||

| Inputs to new construction | 17.6% | 18.8% | 9.7% | 7.3% | 2.0% | ||||

| Inputs to new residential construction | 19.2% | 19.8% | 9.0% | 8.4% | 2.7% | ||||

| Inputs to new non-res construction | 15.8% | 17.6% | 10.6% | 6.2% | 1.5% | ||||

| Inputs to commercial construction | 15.2% | 16.0% | 10.4% | 5.9% | 1.6% | ||||

| Inputs to healthcare structures | 16.2% | 16.7% | 10.0% | 6.0% | 1.8% | ||||

| Inputs to industrial structures | 16.2% | 14.9% | 9.9% | 5.2% | 1.5% | ||||

| Inputs to highways & streets | 12.1% | 16.2% | 10.3% | 5.4% | 1.0% | ||||

| Inputs to power & communication structures | 14.6% | 18.3% | 11.3% | 6.7% | 1.7% | ||||

| Inputs to educational & vocational structures | 17.7% | 17.4% | 10.1% | 6.4% | 2.0% | ||||

| Construction materials (PPI ‘Special Index’) | 24.8% | 23.8% | 17.7% | 13.8% | 5.2% |

The ‘service’, ‘commodity’ and ‘energy’ indices (in the middle section of the table) are based on ‘factory-gate’ sales prices.

The ‘input’ indices (at bottom) reflect costs faced by contractors. They exclude capital investment (i.e., machinery & equipment), labor & imports.

The ‘input’ indices are built up from the ‘service’ (design, legal, transport & warehousing, etc.) ‘commodity’ and ‘energy’ indices.

Table: ConstructConnect.

Please click on the following link to download the PDF version of this article:

Economy at a Glance Vol. 17, Issues 72, 73 and 74 – Shockingly High Material Cost Hikes Set out in 2 Tables & 24 Graphs – PDF

Alex Carrick is Chief Economist for ConstructConnect. He has delivered presentations throughout North America on the U.S., Canadian and world construction outlooks. Mr. Carrick has been with the company since 1985. Links to his numerous articles are featured on Twitter @ConstructConnx, which has 50,000 followers.

Recent Comments