There will be a slight contraction in the Canadian construction industry this year, mainly due to a decline in the residential building sector.

However, it’s not all doom and gloom, according to a report by global consultancy firm Linesight.

On the plus side, the ICI sector, along with energy and utilities, and infrastructure segments, are expected to be busier across the country this year and in 2024.

“It’s positive compared to what we’ve seen since 2021 when COVID hit,” explains Jonathan Scully- Lane, an associate director at Linesight’s office in Vancouver. “Finally, we’re seeing some positives in these reports that are coming out such as the levelling of the supply chain.

“Obviously there are issues. The labour situation is not all good and there are definitely some challenges that are going to be seen in 2023 and 2024 and onwards, but it is more positive than it has been in the past.”

While supply chain issues are easing, the report indicates it still takes some time for contractors to get certain materials and equipment and there are ongoing challenges with the lack of skilled trades workers. However, with inflation subsiding and prices for materials becoming more stable, the outlook is brighter.

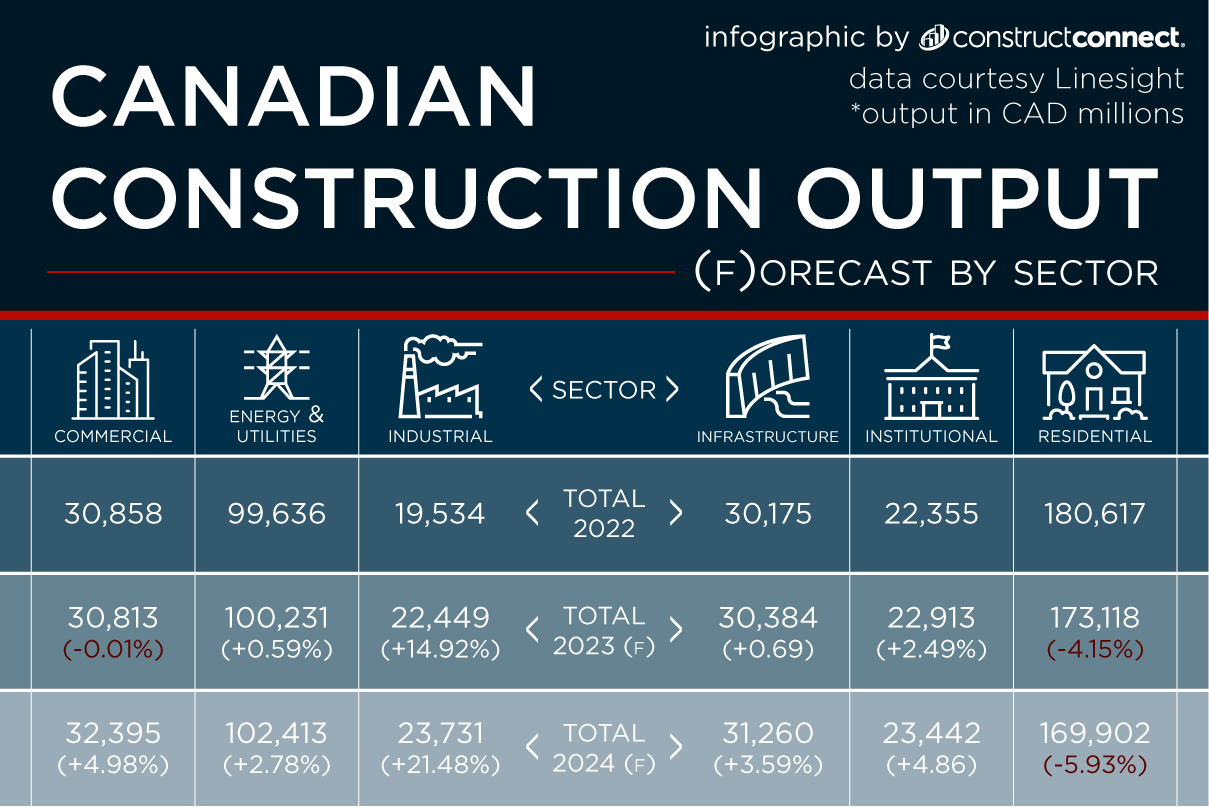

Overall, Linesight’s latest country insight and commodity report indicates the construction industry in Canada is expected to contract by 0.9 per cent in 2023, mostly due to reduced output in the residential sector. However, the ICI industry will likely offset that decline, with an anticipated rise to $76 billion in output in 2023 and to $80 billion in 2024, substantially up from $72.8 billion in 2022.

The energy and utilities sector is expected to grow to $100 billion in work this year and $102 billion in 2024, up from $99.6 billion in 2022, while it is anticipated the infrastructure sector will grow to $30.4 billion worth of work in 2023 and $31.3 billion in 2024, an increase from the $30.2 billion in output in 2022.

As for materials, the cost of lumber is expected to continue to drop, but prices for cement and aggregates will remain higher, according to the report. The consensus is prices for steel, copper and concrete will be flatlined.

The report notes the Canadian economy is expected to experience a more modest growth rate of 1.4 per cent in 2023, down from 3.4 per cent in 2022, but the first quarter of this year has been stronger than projected.

The industrial construction sector is expected to lead the way in the ICI sector, with forecasted growth of 14.9 per cent in 2023. The life sciences sector, meanwhile, is growing because of investor interest and government policy support.

Scully-Lane says the residential market has been hard hit lately because of inflation and interest rate increases that have kept buyers on the sidelines.

“Inflation is incredibly high at the moment, so there’s not a huge amount of money in the market going around for your average consumer to purchase a house, which isn’t helping. The main tool for governments to try to combat inflation is by increasing the interest rates which unfortunately hits the pockets of the average home buyer.”

He says there’s a lot of data centres moving into Canada, especially on the East Coast, which will drive up numbers and the life sciences sector and bio-manufacturing sectors are also picking up steam as the federal government turns its attention to bolstering those fields.

“The Canadian government is doing what they can to address the wave that they had with COVID and part of that is to have very large investments in health care and very large investments in their bio-manufacturing and life sciences,” says Scully-Lane.

Padraig Leahy, a director at Linesight, says there is tremendous investment in the life sciences sector and hyper-scale data centres in the GTA are growing.

In Alberta, he says, the government policy was to shy away from the life sciences sector because it wanted to develop other industries, but authorities are now encouraging investments.

“There’s more of an interest in Canada now where in the past there wasn’t.”

Hyper-inflation of commodities has ceased, and construction companies now have some stability, Leahy says.

“That’s now in the rear-view mirror. We see a more traditional increase in commodity prices.”

However, the industry is not out of the woods just yet.

While lower inflation has driven down the cost of materials and stabilized prices, the price at the factory gates is creeping up because of interest rate hikes and the cost of labour, according to Leahy.

On the residential side, he says the Canadian construction industry has not been as hard hit as other markets like the U.S. because the country has significantly more immigration which has created market demand. However, rising costs have slowed the residential market and developers are more cautious moving forward.

Leahy expects once inflation is fully under control and interest rates start to drop, the pace of home buying will pick up dramatically.

Recent Comments