BuildForce Canada has released its 2025–2034 Construction and Maintenance Looking Forward report for the Atlantic provinces, which is showing a mixed bag when it comes to what will be driving construction growth in specific areas and what challenges lie before those on Canada’s East Coast.

Whether it’s a residential construction boom, major ICI projects or replacing a retiring workforce, the construction sector is poised for growth in certain areas, while limited in others.

And all of this is amidst a backdrop of global economic uncertainty. BuildForce is making it clear its investment trends and employment projections were developed with industry input prior to the emergence of potential trade tensions between Canada and the United States.

The forecast does not take into account the possible impacts of tariffs.

Construction sector success hinges on major projects for Newfoundland

According to the report, construction investment growth in Newfoundland and Labrador was modest in 2024. Both the residential and non-residential sectors reported growth in activity, with gains of three per cent and two per cent, respectively.

“Although the former benefitted from growth in new housing construction, activity in residential renovations – which is the principal driver of residential investment in the province – was unchanged from 2023,” a release states.

“Activity in the non-residential sector, meanwhile, was driven by ongoing work on various major engineering-construction projects, including the West White Rose offshore oil platform, Voisey’s Bay underground mine, and Marathon Gold’s Valentine Mine.”

When it comes to the future, however, the outlook for residential is muted. While it is anticipated to growly strongly into 2029, it will slow in later years with renovations helping to stem the tide.

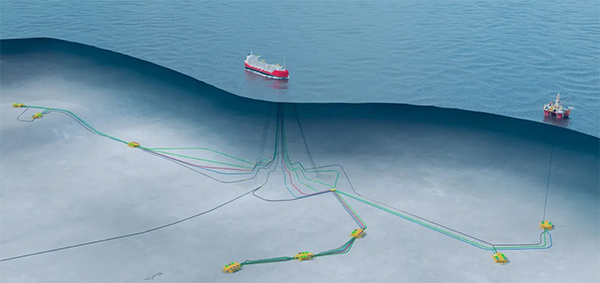

The non-residential sector is tied to several major projects. After a slight pause in 2029, engineering construction investment rises sharply with work on the proposed Bay du Nord project.

Across the outlook period, overall construction employment is projected to increase, as growth of 20 per cent in the non-residential sector offsets a contraction of just under six per cent in the residential sector.

“Entering our forecast period, the non-residential construction labour force in Newfoundland and Labrador is likely in a surplus position. Several key major projects have concluded in the past 12 months, while the status of several proposed projects is less certain,” says Bill Ferreira, executive director of BuildForce Canada. “Should these projects proceed, the province is expected to see significant growth in its non-residential outlook.”

The labour force is another variable for the province, with its older population. As many as 6,100 workers are expected to exit the industry by 2034, leaving a hiring gap of as many as 8,300 workers by 2034.

New Brunswick could see growth, but replacing retiring workers a challenge

Construction activity in New Brunswick increased in 2024, as the residential sector saw growth in both the new housing and renovation components, BuildForce reports. Its non-residential construction sector saw growth in both engineering and ICI construction.

Although the outlook calls for both sectors to record growth by 2034, they follow different paths.

Investment in new housing is projected to cycle down to 2029, but growth is strong in residential renovations throughout the decade, becoming the key investment driver by 2026. Later years see demand for new housing return to growth.

Non-residential is projected to be moderate across the short-term but investment rises between 2027 and 2031 as work begins on the Mactaquac Life Achievement Project and combines with ongoing work at the proposed Irving Pulp and Paper NextGen capital improvement project.

When it comes to employment, residential is largely unchanged from 2024 but non-residential employment is projected to rise by six per cent.

“Many of the trades and occupations tracked by BuildForce Canada in New Brunswick enter the forecast period under strained conditions, given the volume of work that was underway across the province’s residential and non-residential sectors in 2024,” says Ferreira. “With investment levels rising out to 2030, the industry has the opportunity to augment recruitment in order to avoid future labour force pressures related to increased retirements.”

The province could see the retirement of 6,500 workers and may need to hire as many as 8,400 by 2034.

“The projected recruiting of some 6,700 first-time new entrants from the local population should help meet most of these requirements, but in the absence of new approaches to recruitment, the industry could still face a shortfall of some 1,700 workers by the end of the decade,” the report adds.

P.E.I. labour market balance leaves ‘no room for complacency’

Both the residential and non-residential construction sectors in Prince Edward Island recorded growth in 2024, but its future forecast calls for investment levels in the two sectors to diverge to the end of the forecast period.

Activity in the residential construction sector is expected to rise significantly into 2030. While a contraction follows, it is offset by consistent growth in demand for residential renovations.

“These trends combine to elevate residential employment levels in the province by 12 per cent above 2024 levels by 2034, with growth greatest in employment relating to renovations and maintenance activity,” the report notes.

Non-residential is projected to contract into 2030 due to slowing activity of ICI buildings as work concludes on several major projects. By 2034, non-residential construction employment is projected to contract by nine per cent compared to 2024 levels.

Overall, P.E.I.’s labour force should be balanced for most of the forecast period. There is the anticipated retirement of 1,680 workers, which means the province’s hiring requirements could reach as many as 1,760 workers over the entire outlook period.

“Although it is encouraging to see long-term balanced labour market projections for the province’s construction labour force, there is no room for complacency,” says Ferreira.

Strong residential growth in Nova Scotia, large hiring gap looms

Construction activity in Nova Scotia recorded another strong year in 2024, with both residential and non-residential reporting gains over the previous year. The forecast, however, is calling for construction growth in 2034 but with gains limited to the residential sector.

“Residential construction investment levels are projected to grow into 2025 and are sustained into 2027 before increasing steadily to the end of the decade,” it reads. “By 2034, residential employment should be 21 per cent higher than 2024 levels, with significant gains anticipated in employment relating to residential renovations and maintenance activities.”

Non-residential construction is anticipated to ebb and flow, coinciding with the timing of major projects.

The forecast states it will rise to a peak in 2028 as core construction work begins on key builds such as the EverWind hydrogen project and is sustained by ongoing health care sector developments. Investment contracts into 2030 as these projects conclude. As a result, non-residential employment is projected to rise nine per cent above 2024 levels by 2034.

Nova Scotia also faces an aging labour force with an estimated 8,400 workers expected to exit the industry by 2034.

When this figure is combined with requirements created by rising construction demands, the province could face a hiring gap of as many as 15,000 workers.

To alleviate some of the shortfall there’s the expected recruitment of as many as 7,900 first-time, new-entrant workers from local labour sources over the decade.

Recent Comments