Construction got off to a weak start in 2025, with January’s total starts spending falling more than 30% year-on-year (YoY). Monthly Construction Starts spending since November has been unusually weak, totalling just $186 billion.

The last time a three-month period reported such a lackluster total was in February 2022. Historically, February marks a seasonal low point in starts spending each year. The fact that the industry has already fallen to multi-month historic lows in advance of the seasonal low point is a concerning sign.

Many commercial real estate (CRE) developers face unexpected challenges early in 2025. The most significant of these may be persistent inflation, which registered at 3.0% in January, the highest reading since May 2024. On a monthly basis, inflation increased by 0.5%, the highest 1-month increase since August 2023.

Above-target inflation, defined by the Federal Reserve or the “Fed” as an inflation rate above 2%, suggests that the Fed will maintain its current monetary policy, leaving interest rates near current levels. To clarify, the Fed does not have absolute control over commercial debt rates.

Rather, the Fed only influences these rates, which are decided by debt market participants who consider a wide array of economic and non-economic variables when determining what level of interest to charge when lending capital.

Additionally, developers continue to face rising vacancy rates for offices and industrial properties, according to data from MSCI and CoStar. Such deteriorating conditions may explain why lenders have, in general, increased interest rates on such properties while holding rates steady on hotel and retail | properties, which performed better in 2024.

Finally, as prices for existing properties begin to recover from their 2024 declines, the choice between developing new properties versus buying existing properties could once again move in favor of new construction.

ConstructConnect’s Economics Group continues to be optimistic about the outlook for the construction economy, given the pro-growth mindset of the new presidential administration, the electrification of the economy, and America’s renewed emphasis on being a world leader in advanced electronics and other manufactured products.

The federal government’s ambitious plan to create a more even playing field for US corporations could create a new wave of private infrastructure investments in 2025 and beyond.

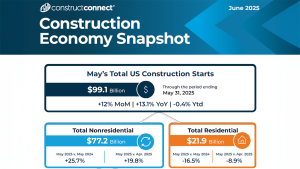

Read the Construction Economy Snapshot for more details on construction labor, trend graphs, and regional analysis.

Recent Comments