Construction economists assembled for a recent spring economic forecast outlined a litany of threats to growth in the sector, with the Donald Trump tariffs and his crackdown on immigration near the top of their lists.

Ken Simonson, chief economist with the Associated General Contractors of America (AGC), told viewers dialled in to the Construction Economy Outlook webcast May 8 that the medium-term outlook for the sector was modestly positive but with a growing risk of decline.

Higher tariffs will raise costs and invite retaliation, which may disrupt supply chains, Simonson said.

And with migrants accounting for 25 to 30 per cent of the American construction workforce, he added, lower targets and deportations will worsen construction labour shortages.

Another contributor, American Institute of Architects (AIA) chief economist Kermit Baker, highlighted those two causes as well as housing unaffordability and federal job losses and spending cuts on his list of economic threats — he noted as of April, 260,000 jobs had been eliminated by the Trump administration and there had been $160 billion in spending cuts.

‘Downbeat’ note

Simonson wrapped up his presentation on an admittedly “downbeat” note: “Immigration now having been almost completely shut off, perhaps a negative on a net basis, as people leave the country, either voluntarily or through deportations, many states that have been growing may not grow and that will have negative consequences, both for the supply of construction labour and demand for many types of projects.”

ConstructConnect chief economist Michael Guckes also outlined “real challenges” facing the economy starting in 2025, with expected growth now significantly lower than projected in January.

“At the beginning of this year, we were looking at closer to a two-and-a-half per cent GDP forecast,” he said. “Now that is cut that in half.”

The spring webcast was presented by ConstructConnect with participation from the AGC and AIA. The event was hosted by ConstructConnect vice-president of economic content Paul Hart.

Avoiding recession

On the positive side, Guckes, quoting analysis by Oxford Economics, suggested the U.S. economy may avoid a recession as Americans withstand policy whipsawing.

GDP growth in the U.S. was 2.8 per cent in 2024. It’s expected to slip to 1.2 per cent in 2025, inch up 1.6 per cent in 2026, 2.6 per cent in 2027 and another 2.6 per cent in 2028.

In Canada, GDP growth was 1.5 in 2024, but it’s anticipated to rise only 0.7 per cent in 2025 and venture into negative territory, down 0.2 per cent, in 2026. A rebound could see the Canadian GDP spike 3.2 in 2027 before receding to 1.9-per-cent growth in 2028.

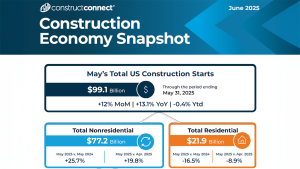

Guckes reported the total number of construction starts in the U.S. is expected to decline 1.8 per cent in 2025 but rise 2.1 per cent, 5.4 per cent and 4.8 per cent the next three years.

For Canada, the forecast is for a drop of 8.6 per cent in 2025 and another 1.0 per cent in 2026, followed by gains of 4.3 per cent and 4.0 per cent in 2027 and 2028.

Simonson suggested economic growth will continue but the risks of inflation and recession are increasing.

The expectation of larger deficits may push interest rates higher, he said, but the lowering of federal regulatory hurdles may help projects start sooner. Data centres, power projects and infrastructure works are the best bets for growth.

Multifamily residential, warehouses and office are likely to suffer declines through 2025 given high costs and weak demand.

Labour costs may increase four to five per cent, and availability remains a challenge unless layoffs become widespread.

Materials costs have levelled off and may rise only about one to three per cent, Simonson said — but they will spike much more if tariffs last.

“Tariffs will cause at least a one-time bump in materials costs,” he said. “But I think the more dangerous effect is what countries do in response to whatever level of tariffs it winds up being.”

The main rationale for tariffs, Simonson said, is that large manufacturers will say, “We’re going to increase building in the U.S. as a result of tariffs that we want to avoid, or because the tariffs are now creating more opportunity for us by protecting us from imports.

“But nevertheless,” Simonson said, “I think the risk is that manufacturing construction will also decline.”

Baker suggested the impact of a trade war with China cannot be overestimated: “The New York Times recently reported that China currently makes almost one out of every three physical products in the world.”

Recent Comments