P.E.I.’s economy grew by a country leading 2.6% in 2018 for the first time in 17 years. This growth was the result of strong domestic demand that was driven primarily by record net migration plus a moderate acceleration in exports.

Unlike Newfoundland and Labrador (see Snapshot #19) across the Gulf of St. Lawrence that has been experiencing a steady outflow of migrants to other provinces, Prince Edward Island, aka the Garden of the Gulf, has, since late 2016, seen an unprecedented inflow of international migrants plus a net gain in interprovincial migration. Over this period, the province’s headcount has increased by an average of 2.2% y/y, well above the 1.4% y/y gain recorded by the country as a whole.

On the doorstep of 2020, the province’s economy appears to be firing on all cylinders fuelled by the sustained growth of exports, consumer spending, business investment and government spending. Year to date, P.E.I.’s merchandise exports are up by 11%, well ahead of the -0.6% drop they exhibited during the first nine months of 2018. Major contributors to this year’s stronger pattern of foreign sales include: frozen lobsters mostly to China (up 30%), aircraft propellers to the U.S. (also up 30%) and pharmaceutical products. Exports of potatoes, the province’s main export commodity, are off by 10% due to weaker U.S. sales. Looking ahead, it will be difficult for P.E.I.’s exports to accelerate in 2020 given the darkening clouds over the global economy in general and the U.S. in particular. However, the outlook for the province’s lobster exports to Asia and aerospace products to the U.S. remains positive.

The record inflow of international migrants has had a significant impact on several key aspects of P.E.I.’s economy. First, over the past 12 months, P.E.I.’s workforce has increased by 3.3%, just slightly behind Ontario (+3.5%). Almost all (85%) of the new jobs were full time and in the private sector. This surge in hiring has contributed to a significant increase in housing demand. Indeed, over the past four years, the province’s rental apartment vacancy rate has fallen from 4.9% to 0.3%, the lowest in the country. As a result, starts of multi-family dwellings rose by 46% in 2017, 40% in 2018 and are up by a staggering 94% this year to date.

Low interest rates and strong full-time job growth have also helped to boost demand for owned accommodation reflected by a 16% y/y rise in existing house prices (September), well ahead of the 4.6% y/y increase they posted in the same month a year earlier. The fact that prices are up by double digits and the months’ supply of homes for sale is relatively low suggests that the market for affordable single, semi and row dwellings is undersupplied.

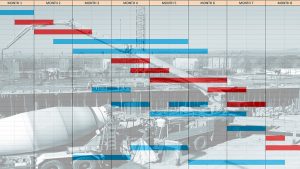

After reporting a 22% gain in 2018, the Atlantic Provinces Economic Council’s (APEC) Major Projects Report calls for investment in P.E.I. to rise by 24% this year largely on account of increased spending on residential projects (+$43 million), on public infrastructure (+$31 million) and by manufacturing firms (+$43 million). Taking a closer look at residential construction intentions, approvals for multi-family units are up by 64% year to date, more than offsetting a 34% drop in single-family approvals. This suggests that a limited supply of single-family homes will cause house prices to outpace the country as a whole well into 2020. After hitting a record high of 1,090 in 2018 and with starts year to date up by 50%, we expect starts in the range of 1,400 to 1,600 this year and in the range of 900 to 1,200 in 2020.

While non-residential investment will add less to P.E.I.’s growth than residential investment due to a pull-back in commercial construction, spending on industrial projects is projected to almost double this year and remain strong in 2020. Industrial projects which are currently underway or planned in the province include the expansion of Canada’s Island Garden’s greenhouse and warehouse facilities and also BioVectra Inc’s biopharmaceutical facilities, both of which are located in Charlottetown.

In 2020 and 2021, spending on major projects should be supported by the expansion of the Hermanville/Clearspring windfarm and the construction of a multi-use sports and events centre in Charlottetown. In both years, government spending on infrastructure will see significant growth.

In light of the strong pattern of exports, consumer spending, residential construction and public and private spending on major projects, we expect the economy to grow by 2.0% to 2.5% this year. Next year, the slower growth of business spending and a softening in exports should cause the pace of growth to moderate to 1.5% to 2.0%.

John Clinkard has over 35 years’ experience as an economist in international, national and regional research and analysis with leading financial institutions and media outlets in Canada.

Real* Gross Domestic Product (GDP) Growth – Prince Edward Island vs Canada

Chart: ConstructConnect – CanaData.

Recent Comments

comments for this post are closed