You might call the last 12 months a milestone year in the corporate history of Vanbots, but for two very different reasons. Not only did the multi-diversified general contracting firm celebrate longevity — 50 years of building the Canadian landscape — Vanbots also recognized the first-year birthday of its partnership with Carillion Canada

Leaders 2009

PETER KENTER

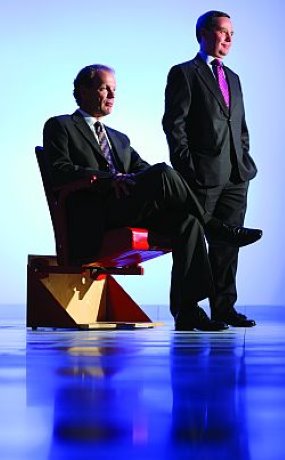

Photo:Tim Fraser

You might call the last 12 months a milestone year in the corporate history of Vanbots, but for two very different reasons. Not only did the multi-diversified general contracting firm celebrate longevity — 50 years of building the Canadian landscape — Vanbots also recognized the first-year birthday of its partnership with Carillion Canada

And it is the birth of the new entity that has the industry leaders excited. Far from a takeover, the carefully considered union was something both parties had been discussing for some time.

Carillion, with its global headquarters in the United Kingdom, was one of the first companies to enter the world of public-private partnerships (P3s). In Canada, the diversified company is one of the country’s largest providers of road management services through TWD Roads Management in Ontario and Carillion Alberta in the West. The company also led the development of such major P3 projects as Brampton Civic Hospital, Royal Ottawa Mental Health Centre and the new Sault Area Hospital, as one of the leading providers of PPP project services in Canada, providing finance, construction and facilities management services.

While it possessed a civil engineering capability, what Carillion Canada sought to fuel its domestic growth was an in-house capacity for ICI construction.

Vanbots, on the other hand, is one of Canada’s largest construction companies with revenues exceeding $600 million. It’s been involved in such signature projects as The Royal Ontario Museum’s Michael Lee-Chin Crystal, expansion of the Vancouver International Airport, renovations to the Bank of Canada building in Ottawa, the construction of Honda manufacturing facilities in Canada, the U.S., and the U.K., renovations to The Sony Centre in Toronto and upcoming work on the Aga Khan Museum and Ismaili Centre in Toronto. What Vanbots needed to take the next step in its growth was an increased capacity to bid confidently in the complex financial world of large-scale P3 projects.

McMaster University, DeGroote Centre for Learning and Discovery, Hamilton, Ontario

“What we’re building here is something unique in Canada,” says Graham Brown, President and CEO of Carillion Canada. “We’re combining ICI building expertise with development expertise and financial management expertise to create a single integrated entity that allows us to provide clients with a full range of services from initial design right through construction and full operation.”

Matt Ainley, Vanbots’ former president and now Executive Vice President of Construction under the Carillion flag, concurs with Brown.

“About three and-half years ago we had a strategic vision that preceded the acquisition, and part of that was to grow into the P3 marketplace,” says Ainley. “We set out doing that and realized there were a lot of challenges.

“We saw what was happening in British Columbia and also realized what was happening in Ontario when Infrastructure Ontario was formed. We realized we had a building capacity that exceeded our balance sheet by a large amount.”

Vanbots tested the waters with a build-finance contract on the Sunnybrook Health Sciences Centre’s massive M Wing Expansion project, something Ainley refers to as “P3 light.” Partnering with Vanbots was Carillion Canada.

“The two companies weren’t even in the dating phase at that point,” jokes Brown. “We were still ‘just friends.’ ”

The companies were independently bidding on Barrie’s Royal Victoria Hospital construction project in 2008 when merger talks began.

Mt. Sinai Hospital seismic upgrades and six-storey addition starting at the fourteenth floor, Toronto, Ontario.

“As the merger talks became more serious — probably only three or four people knew about it at the time — it became clear that we had to put arrangements into place so that, as soon as the deal went through, we didn’t wind up competing with each other,” says Brown. “We ultimately won that contract as a combined entity.”

Brown notes that the partnership not only leverages Vanbots’ construction expertise and Carillion’s facilities management skills, but Carillion’s development capability as well.

“It’s the glue that holds the deal together,” he says. “It’s actually investing in the project — Carillion is a big equity investor — and bringing together the other investors and raising the investment funds. At this point, our major competitors don’t have this development capability.”

Part of what makes the partnership a success is a meshing of corporate cultures, says Ainley.

“Vanbots grew in the 1990s because we decided that we wanted long-term relationships,” he says. “Hunting for work was a drain. It’s much easier to keep a client than to find a new one. We took on a culture of service, and over a few years we grew our repeat business from about 15 per cent to about 65 per cent.”

That long-term approach to customer service meshed with the type of service Carillion Canada insisted on providing its customers, particularly over the long periods inherent in P3 projects.

“When you think about approaching a client knowing you may be entering into a 30-year relationship with them, that changes the dialogue considerably,” says Brown.

The $80 million reconstruction of the Maplehurst Correctional Complex in Milton was Ontario’s first ‘super-jail’ design.

Sometimes overlooked in such acquisitions, sub-trades were also approached at the time of the merger, and asked what sort of relationship they hoped to see with the larger company.

“The sub-trades, architects and engineers have actually welcomed us moving into this market because it gives them more choices and opportunities,” says Brown.

What does the coming year hold for the Vanbots and Carillion partnership?

“We’ve had a good year and 2010 is looking good as well,” says Ainley.

The company is currently bidding on four P3 contracts (one being the Centre for Addiction & Mental Health) part of the overall strategic goal of bidding on an average of five P3 projects at any given time.

Ainley sees government infrastructure spending as the strongest construction trend of 2010.

“The private sector is relatively dead for 2010,” he says. “We’ve got private sector work on board, but the private sector is still having trouble borrowing money. Currently, there’s a building program at virtually every college or university.

“The (federal) Knowledge Infrastructure Program is really driving the construction marketplace right now for maybe a dozen or more really good contractors.”

Brown says that initial skepticism about federal infrastructure spending seems to be giving way to optimism.

Recently Brown was talking to a top official at Infrastructure Ontario about the rolling out of the federal stimulus package. “He was as suspicious as anyone six months ago, but now the money is really flowing.”

“I think we’ll really see some impact through 2010 and that will benefit the whole of the supply chain, including the smaller builders.”

Ainley predicts that it may be a year before banks begin to relax and resume lending to the private sector. “There could be a gap as the infrastructure spending tails off and the private sector construction spending resumes,” he predicts.

But Brown says the company is in good shape to weather any temporary dislocations.

“Carillion operates a portfolio of businesses that help to protect shareholders and employees against dislocation in the market,” he says. “We’re exposed to the building cycle for sure, but we have a strong services business which tends to ride out recession very well.”

Part of the problem with some mergers and acquisitions is the loss of corporate identity. That hasn’t become a concern for Vanbots, says Ainley. “It was a bit of an awakening for our staff, but they realized that Carillion wasn’t buying so much a company as it was buying a brand.”

That’s not the way most construction companies think of themselves.

“If you think about it from Carillion’s point of view, we had to ask ourselves, what we were buying at the end of the day,” says Brown. “There aren’t any real assets bolted to the floor. You can’t go into a warehouse and count out how many widgets there are. What you’re buying is the expertise and talent and reputation of a group of people—the people are the brand.”

It’s an important distinction, especially in the brave new world of P3s that will see partnerships structured to last 30, 40, maybe even 50 years.

“The corporate culture and brand of a company will become even more important in the future,” says Brown. “Many of the deals we broker today will outlive the people who make them. The values of the people who write those agreements will live on in the company’s values.”

1/4

Leaders 2009

2/4

McMaster University, DeGroote Centre for Learning and Discovery, Hamilton, Ontario

3/4

Mount Sinai Hospital

4/4

Maplehurst Correctional Complex, Milton, Ontario

Recent Comments

comments for this post are closed